haven't done my taxes in 3 years canada

Ad Owe Over 10K in Back Taxes. Then reach out to the CRA 1-888-863-8657 to find out what your options are.

Personal Income Tax Guide The Deadline For Filing Your 2021 Return Tax Brackets And More Moneysense

I didnt file taxes for four years 2011-2014.

. Filing Taxes Late In Canada. The IRS estimates that 10 million people fail to file their taxes in any given year. File your tax returns on time even if you cant afford to pay taxes you owe.

The BC corporate registry is separate from the Canada Revenue Agency. Additionally failing to pay tax could also be a crime. I live in Ontario Canada any recommendations on who to talk to.

If youre required to file a tax return and you dont file you will have committed a crime. Questions Answered Every 9 Seconds. Luckily filing and paying your taxes is still possible even if you havent filed in a while.

I havent filed my taxes in three years and I believe I lost my T4 from three years ago also I changed jobs within those three years. We can help Call Toll-Free. If you havent filed tax returns the IRS may file for you.

If you havent filed your corporate registry documents in the last three years your company is in danger of being struck from the corporate registry. The criminal penalties include up to one year in prison for each year you failed to file and fines up. Ad A Tax Advisor Will Answer You Now.

Tax Relief Help Help With IRS Back Taxes 2022 Top Brands Comparison Online Offers. The state can also require you to pay your back. -I found all 3 of my T4 slips today -I rent a 2 bedroom apartment for myself.

If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation. They are very helpful and will mail you all of your T4s and any other relevant tax documents that you need. Self-employed workers have until June 15 2018 to file their tax return.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. You dont have to file taxes if There are very few circumstances that excuse your obligation to file. These Tax Relief Companies Can Help.

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. Not filing a tax return on time is one of the most common tax problems. I have a part time min wage so I dont think Id owe.

This is called a substitute for return SFR. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. This can have serious consequences when it comes to filing your corporate tax or non-profit i See more.

Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000. The first step in getting out of your tax mess is calling the IRS. You can make partial.

If You Dont File Your Return the IRS May File a Return for You. Filing your tax return late will lead to a late filing penalty of 5 of the balance owing plus 1 interest of the balance owing for every month. -I know ill be receiving money instead of owing.

Most Canadian income tax and benefit returns must be filed no later than April 30 2018. Under the Internal Revenue. If you have any questions about the above information please dont hesitate to call me at 250-381-2400 and I would be glad to help you through the process.

They will want to verify who you are so youll need your name address social security number employer and current salary. If you have unfiled tax. If you fail to file your tax returns you may face IRS penalties and interest from the date your taxes were.

What Can You Claim On Your Income Taxes 7 Deductions Not To Miss Moneysense

Tax Resource Centre Td Canada Trust

Shipping To Canada Taxes Duties Tariffs Stamps Com Blog

How To File A Late Tax Return In Canada

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Is There A Penalty For Filing Taxes Late If You Don T Owe Late Tax Filing Liu Associates Edmonton Calgary

How Are Tax Refunds Affected In A Bankruptcy Bankruptcy Canada

We Break Down The Tax Brackets In Canada For 2021 And Provinces Too Based On Annual Income Moneysense

Closing Canada S Tax Gap Would Raise About 3 Billion Report Investment Executive

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

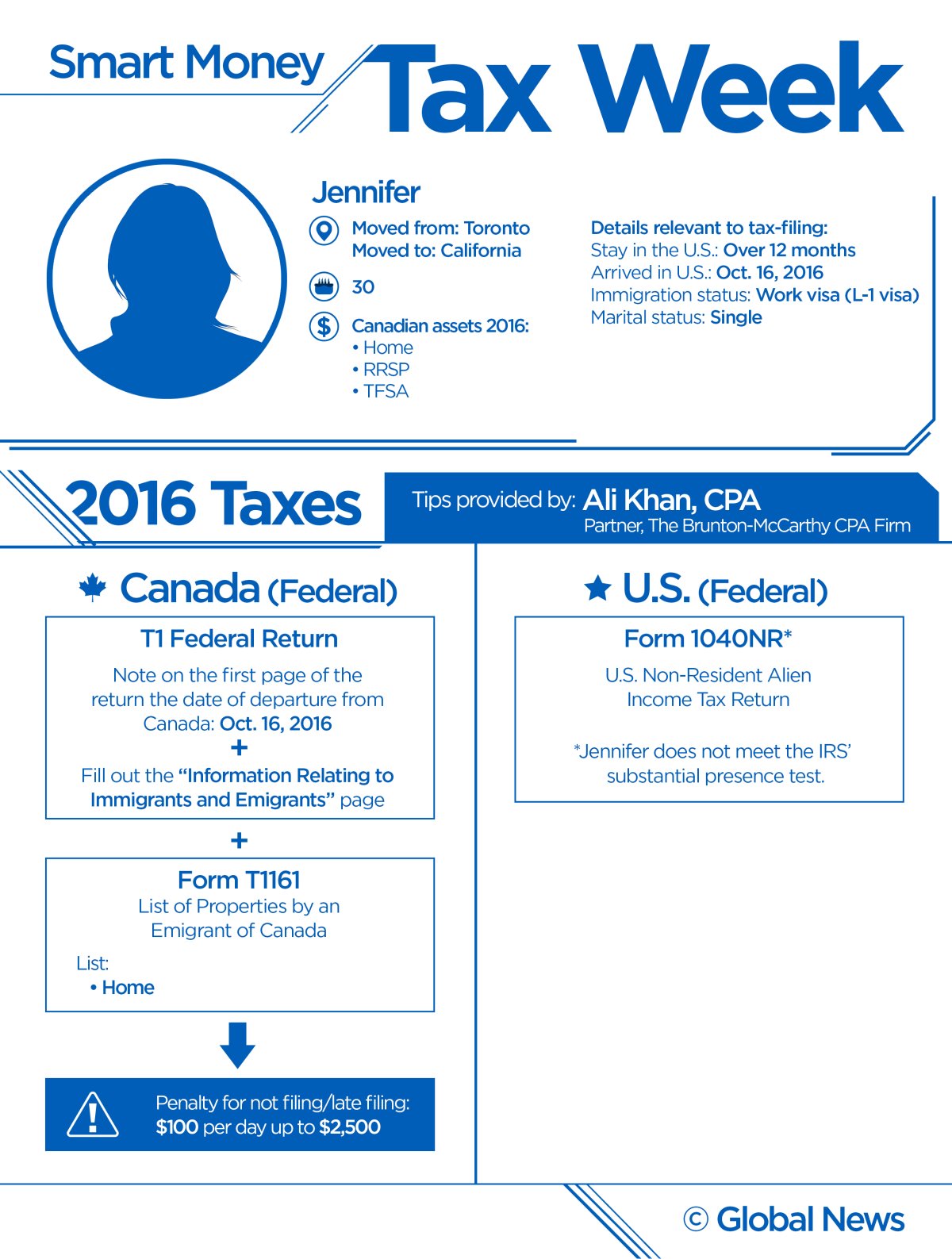

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Deadlines May Be Extended But Don T Wait To File Your Taxes Experts Say Ctv News

Doing Your Income Taxes For The First Time In Canada Get It Right From The Start Canadian Immigrant

When Can You Start Filing Your 2021 Taxes In Canada

Canada I Haven T Done My Canadian Taxes In Six Years What Should I Do Quora

Haven T Filed Taxes In 5 Years Canada Buck Tang

First Time Paying Tax As An International Student R Personalfinancecanada

Canada I Haven T Done My Canadian Taxes In Six Years What Should I Do Quora

2 Million Canadians Who Haven T Yet Filed Taxes Could Face Benefits Interruption Cra Warns National Globalnews Ca